Advisors and founders exploring exit, partial sale, sell-and-stay, or breakaway.

We specialize in working with bank-channel and independent advisors who are managing real books of business — often $100M to $1B+ in AUM.

Whether you’re nearing retirement or rethinking your platform, we help you explore what’s next.

Every transition starts with a valuation — anything else is inefficient and backwards.

We introduce highly qualified buyers — based on cultural fit, funding ability, and the structure you want. Not 30 conversations. Just the right ones.

We stay with you through every step: discovery, valuation, buyer alignment, LOI prep, deal execution, and post-close support.

You didn’t just build a book — you built a business, a brand, and a legacy. And that changes everything.

A great transition multiplies that value — and protects the trust you’ve earned with clients and staff.

Our role is to help you exit on your terms — or evolve with clarity and control.

Most advisors wait too long to run the numbers — or wait for what they perceive as “perfect timing.”

The reality? The strongest transitions happen when you’re in growth mode, not when you’re winding down.

Our 5-minute intake offers a short, precise starting point — just the numbers needed to initiate a meaningful valuation.

No presentations. No firm introductions. No assumptions — just data, so you can make informed decisions.

Most transition consultants take a high-volume, transactional approach.

At Intrinva, we don’t blast your profile to dozens of buyers or rush to close. We move deliberately, based on alignment.

Our approach is selective. Most advisors are shown just a few highly qualified buyers — chosen for funding ability, cultural fit, and deal structure. One great fit is sometimes all it takes.

Intrinva is not a volume shop. We intentionally limit ourselves to 6–10 transitions per year — because the quality of each outcome matters more than the quantity.

We’re a small, high-touch firm — with access to the same buyers, research, and M&A resources as the largest players.

Every advisor we work with receives valuation insight, clear next steps, and curated introductions.

We’re paid by the buyer — so you stay focused on your business while we do the legwork.

Firm Snapshot: Quick intake form to map AUM, revenue, client base, expenses, and estimated EBITDA

Valuation Review: We deliver a professional estimate based on your financials, using real benchmarks and comps

Deal Summary Built: A confidential, buyer-facing profile tied only to an internal ID — no names or personal identifiers

Buyer Match: We select 2–3 trusted firms from our network of 30+ buyers, ranging from private equity-backed groups to boutique succession-focused firms

Meetings & Discovery: Zoom calls, fit conversations, and guided Q&A

LOI Phase: Offers issued. You evaluate. We support.

Due Diligence: Buyer reviews books, compliance records, and financials

Transition: You close on your terms — full exit, phased sale, or stay-on

Years of Experience

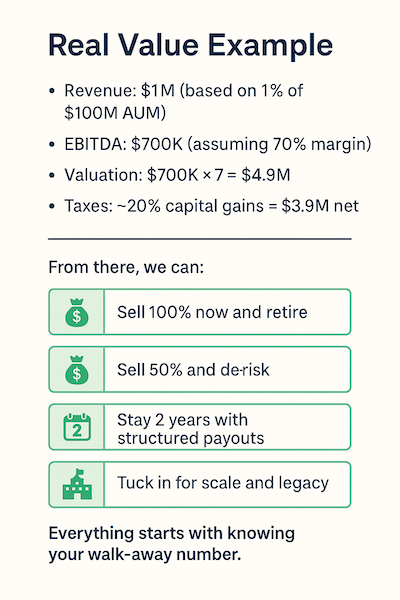

Would you sell half, pay off your house, secure your family, and take risk off the table?

Would you start your own RIA and monetize it later?

These are the right questions — and they all start with knowing your number.

That’s where we start.

I founded Intrinva to simplify one of the most important decisions of an advisor’s career. In my experience, when you start with the valuation and then build the structure, the process flows naturally. Starting with structure first? That’s backwards.

We don’t pitch buyers or pressure sellers. We give you the number, then help you evaluate your options with clarity.”

Let’s talk strategy, not sales. Whether you’re actively exploring or just gathering information, our team is here to help you make smart, confident decisions. No pressure. No obligation. Just clear answers.

Call (214) 551-5102 or fill out the quick form below:

What You Can Expect

A smart starting point — grounded in clarity, not urgency.

Most advisors aren’t looking to sell when we first talk — and that’s exactly the point. Real transitions don’t begin with transactions. They begin with perspective.

It usually starts with a conversation — often months or even years before any real decision is made. We help you step back, evaluate your full picture, and begin shaping a plan from a position of strength.

A meaningful transition — whether five months or five years away — follows a clear sequence:

Valuation comes first.

Structure and timing come second.

Implementation comes last — when the strategy is sound.

Here’s what you can expect:

✔ A 20-minute strategy conversation

✔ A confidential look at what your practice may be worth

✔ A thoughtful, judgment-free space to explore your goals and next chapter

“No two deals are alike — and that’s what makes this work meaningful. Every advisor’s path is unique. Once it’s valued, we can define it, structure it, and guide it forward.

This isn’t a transactional process — it’s built over time, with precision. It’s granular, down to the fine print, the detailed contracts, and the alignment that makes a transition truly work.”

We help financial advisors make confident, informed moves with clear guidance, real data, and support that turns transitions into long-term wins.